Inland Revenue Authority

2Shakes lets you specify IR authority settings that:

capture your clients signed consent for you to access IR information on their behalf.

let you specify the authority text that you want to use

decide if you wish to send a IR597 nominated party form to IR

NOTE: 2Shakes captures the consent to link - then you can link appropriately in myIR.

Setting up your profile

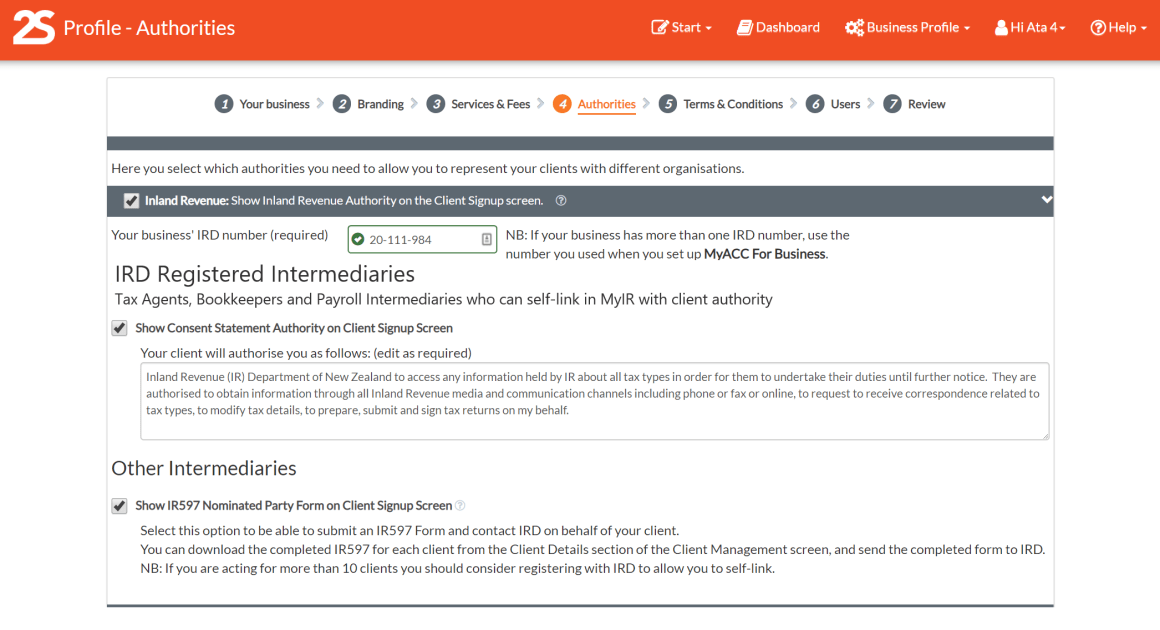

1. To access IR authority settings, click on Business Profile in the top navigation bar, then select Authorities.

2. If you work with Inland Revenue for clients then select Inland Revenue: Show Inland Revenue Authority on the Client Signup screen using the check box in the dark grey bar.

3. Enter your IRD number. Note if your business has more than one IR number, then we recommend you use the IR number you have used when you set up MyACC for Business. As this IR number will also be used on any ACC1766 forms you submit using 2Shakes.

4. Check the authority text that will appear on the agreement that your client will sign. You can edit or reword this.

5. Select if you want the option of capturing IR consent using a text statement, submitting an IR597 form to Inland revenue, or both. Note: The IR597 form gets completed and signed by your client. It gives you the ability to phone IR and ask questions about the client. Anyone can use this form (regardless of whether you are registered as an intermediary as a tax agent, bookkeeper or payroll professional, or not).

6. If posting, send the printed form to Inland Revenue at:

PO Box 39010

Wellington Mail Center

Lower Hutt

7. Once it is received, IR typically take 5 working days to action this form.

IR Authority Wording

2Shakes uses standard IR authority wording which we update from time to time, for example:

To access any information held by Inland Revenue (IR) Department of New Zealand about all tax types (except Child Support, Paid Parental Leave or KiwiSaver accounts) in order for them to undertake their duties until further notice. They are authorised to obtain information through all Inland Revenue media and communication channels including phone or fax or online, to request to receive correspondence related to tax types, to modify tax details, to prepare, submit and sign tax returns on my behalf.

You can alter the authority wording in your Business Profile to suit your circumstances.

Disbursement Authority

For example, if you wish to have your clients IR refunds paid into your bank account you should hold evidence of your clients authority to do so. You might alter this standard authority statement as follows:

To access any information held by Inland Revenue Department of New Zealand about all tax types (except child support) in order for them to undertake their duties until further notice. They are authorised to obtain information through all Inland Revenue media and communication channels including phone or fax or online, to request to receive correspondence related to tax types, to modify tax details, to prepare, submit and sign tax returns on your behalf. They are also authorised to receive your refunds or credits from Inland Revenue

More Help

Didn’t find what you need here? You can find lots more help on our main Support Page.

Or you can contact us or email us at support@2shakes.co.nz and we can help you with what you need to know.

Thanks very much,

The 2Shakes Team