Audit, Reporting & Statistics

In NZ, if you are captured by AML/CFT then you must submit an AML annual report by the 31st August for the year ending 30 June. To do this you need to be registered as a reporting entity with DIA. The report for Phase 2 entities is DIFFERENT to the report for Phase 1 entities (see S2A of the regulations) and is outlined in DIA’s User Guide.

AML Annual Report Video

Watch this 17 minute video based on our AML Annual Report webinar.

The AML/CFT annual report is made up of 6 parts. This page describes each of the 6 parts of the Phase 2 AML/CFT annual report and how 2Shakes helps you complete it.

The parts of the report

Part 1: Enter the period, contact details and organisation structure. The reporting year is 1 July to 30 June. The period for the first year (2018/19) is a part year for the Accounting sector (1 Oct to 30 June) and the Real Estate sector (1 Jan to 30 June). The AML Statistics report caters for part years, by allowing you to select the period of the report.

Part 2: Describe how your AML programme and Risk assessment comply with S57 and S58 of the Act and what reviews or audits you have had. We recommend securely storing the correct and latest versions of your AML documents in 2Shakes.

Note: If you are part of a Designated Business Group (DBG), only one business in the DBG needs to complete part 2 on behalf of the rest of the group. But all the other businesses in the DBG need to complete sections 1,3,4,5 & 6 for themselves.

Part 3 – Products & Services: You need to provide the number of times or total value of AML ‘in-scope’ products or services you provided. This includes things like Legal arrangements formed, Nominee roles held, Registered offices, Value of managed client funds (including tax transfers), Real Estate or specified legal services provided.

Part 3 – Supplementary Activities & Questions: It asks if you perform certain activities. It asks for an estimate of the proportion of your business that is cash, what value of funds you transfer to other countries. You list your 3 most common in scope products or services.

Part 3 – Customers: 2Shakes provides statistics on Customer Due Diligence to help you complete part 3 of the annual report.

How Many Customers

Question 8.1 of the annual report asks you to estimate how many customers you conducted CDD on in the year in the course of carrying out activities regulated by the Act. The AML statistics report shows you the total number of customers that you completed CDD on using 2Shakes.

ADD the number of All AML Customers for organisations + individuals together. For example in the screen shot above this is a total of 37 + 18 = 55

Types of customers

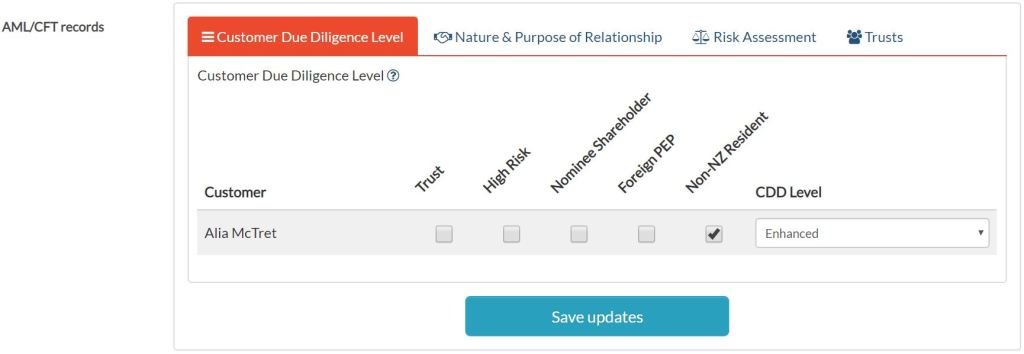

The type of customers you completed CDD on using 2Shakes is shown in the AML Statistics report. It adds up the tick boxes in the CDD level tab of the AML CFT records section, for all customers with a status of Complete. In the example below, this will be added to the statistics report as a non-resident individual.

Method of Customer Due Diligence

2Shakes gives you a count of the different identity verification methods you used for CDD on the AML Statistics report.

Face to Face (Manual)

Face to face is when you have seen original evidence/documents. 2Shakes manual CDD lets you use Notes & Files to record this then mark the IDV as complete. The report also shows if you tried electronic IDV first, but it was unsuccessful, and you manually completed it. The total face to face is the sum is Successful manual CDD in person + Unsuccessful electronic CDD via email then done manually + Unsuccessful electronic CDD in person then done manually.

Non-face to face (Electronic)

Non-face to face is known as electronic IDV. 2Shakes allows you to do electronic IDV in person (for example where the client sends you a copy of the ID, that you type into 2Shakes to verify it) or via email (where your client opens a link from an email and types in their own ID details themselves). The total sum non face to face is Successful electronic CDD in person + Successful electronic CDD via email.

Domestic NZ Intermediaries

If you use someone else to do your CDD for you then you need to report this here.

Part 4 – Sector Specific Questions: You need to answer a number of sector specific questions.

Part 5 – Ministerial Exemption: If you have received a ministerial exemption regarding AML, you would outline it here.

Part 6 – Declaration and Signing

AML Compliance Officer

2Shakes allows users to capture AML related information, complete ID verification and upload evidence documents. When all ID verification is completed it goes to a status of Pending. 2Shakes then has a separate final step, for the AML Compliance officer to review everything then Complete CDD.

AML Reporting entities must assign someone the role of AML Compliance Officer. In 2Shakes users with admin access can select who can act as an AML Compliance officer under the Business Profile > Users section by selecting AML officer.

AML Reporting entities must assign someone the role of AML Compliance Officer. In 2Shakes users with admin access can select who can act as an AML Compliance officer under the Business Profile > Users section by selecting AML officer.

Useful Links

DIA User Guide for Annual Report

AML/CFT Requirements and Compliance Regulations 2011 – Schedule 2A: Annual AML/CFT report by (DNFBP)

http://www.legislation.govt.nz/regulation/public/2011/0225/latest/LMS62293.html

AML/CFT Act – S58 Risk Assessment

http://www.legislation.govt.nz/act/public/2009/0035/latest/DLM2140915.html

AML/CFT Act – S7 Minimum requirements for AML/CFT Programmes

http://www.legislation.govt.nz/act/public/2009/0035/latest/DLM2140914.html

DIA Guidelines

Accountants

Lawyers and Conveyancers

https://www.dia.govt.nz/AML-CFT-Information-for-Lawyers-and-Conveyancers

Real Estate Agents

High Value Dealers

Explanatory Note: Involvement in tax transfers, payments and refunds

More Help

Didn’t find what you need here? You can find lots more help on our main Support Page.

Or you can contact us or email us at support@2shakes.co.nz and we can help you with what you need to know.

Thanks very much,

The 2Shakes Team