Ongoing Customer Due Diligence

As an AML Reporting entity you must carry out Ongoing Customer Due Diligence (OCDD) on clients you have an ongoing relationship with. The 2Shakes OCDD report helps you identify who you need to do OCDD on. It reports a range of trigger events, time periods or types of customers easily find who is due for OCDD. Then 2Shakes helps you perform Ongoing Customer Due Diligence and record it, with options to do a full review, update or re-do of existing Due Diligence.

Best of all – the OCDD report is included for free with the existing charges you pay as part of any 2Shakes paid plan. Even if you have multiple OCDD renewals for a client. You only pay for any additional electronic add-ons you decide to use, that are charged as usual.

OCDD

On this page you can find information on:

• Who is due for Ongoing Customer Due Diligence (OCDD report)

• Performing OCDD on clients

2Shakes has a range of online support to help you:

Contact us to ask a question

Watch the OCDD Webinar

Who is due for Ongoing Customer Due Diligence

When and who you do Ongoing Customer Due Diligence reviews on is part of your AML programme.

OCDD should be done if there is a trigger or after an elapsed period of time. A trigger is a material change you become aware of, maybe during an annual review or after talking to the client. Section 31 of the AML Act requires you to ‘regularly’ do ongoing customer due diligence and account monitoring. What regular means is really up to you and your programme.

A common seen example would be for an AML programme to set a 1 year review for high risk customers, and a 2 year review for all other customers. Events like a change in business operation, address, ownership or management can also be trigger a review.

AML Audit findings can also trigger the need to do Ongoing customer due diligence reviews to correct any CDD issues the auditor found. For example re-doing Identity verification to biometric with PEP, to ensure compliance with the updated Identity verification code of practice.

The OCDD report in 2Shakes is hugely helpful, what ever the reason. It tracks all customers whose initial CDD is completed automatically and allows you to search across different time periods, risk factors, IDV settings and ownership changes..

With Sign Up and AML, the OCDD is done along with an updated Agreement. This is really useful to meet professional standards on client engagement/re-engagement. So doing OCDD at the same time as updating the client Agreement (along with changes to your services, fees, and possibly Ts and Cs) makes sense.

Ongoing Customer Due Diligence Report

Open the ongoing customer due diligence report by using the AML drop down menu from the top navigation bar and selecting Ongoing CDD.

OCDD Report

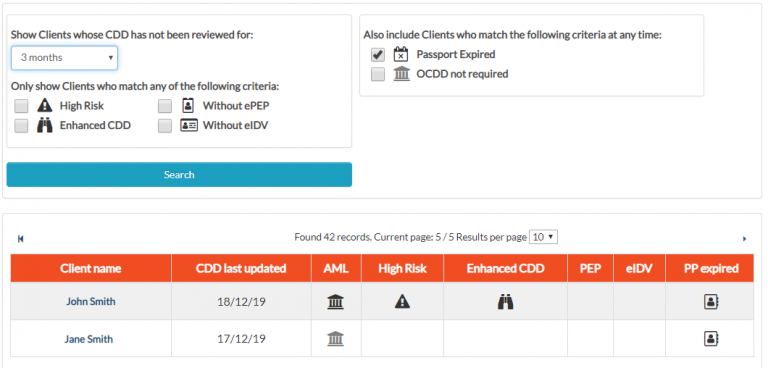

The OCDD Report keeps track of completed ongoing customer due diligence from one place. You can find clients who have not had CDD reviewedin the last 3, 6, 12, 18 or 24+ months, as well as show clients who:

Have been identified as High Risk

Required Enhanced Due Diligence

Have not had an electronic PEP check done, or

Have not been electronically IDV’ed

and any clients who:

Have entered passport details for eIDV and that passport has since expired

Have been deselected for Ongoing Customer Due Diligence

The report uses icons to show you which search criteria matched for each client on the report. The report shows OCDD disabled clients with a grey AML icon instead of black.

OCDD Report Example:

In the example above, the search is for clients whose CDD has not been reviewed for 3 months AND any clients whose passports have expired. Even though the two clients’ CDD has been updated within 3 months, they show in the report because they have expired passports. The OCDD report also tell us:

Both clients have been electronically IDV’ed and had an electronic PEP check as no icons are displayed in the corresponding columns.

John Smith has previously been flagged as High Risk, and Enhanced CDD was applied.

Jane Smith has been deselected for OCDD as the AML icon is grey.

When selected, expired passports and OCDD not required will show in your search results regardless of the selected time frame. Search results show matches from the criteria group on the left AND any criteria selected on the right.

Review the Customer Due Diligence

From the OCDD report you click on a client to review the most recent due diligence. You can then update or change the information an perform OCDD from the client management page.

Turn OCDD off

OCDD for a Client can be switched off and on at any time. Use the Disable Ongoing CDD feature to show you don’t need to carry out Ongoing Due Diligence for this customer. For example, you don’t have an ongoing business relationship with them because they were a one-off transaction or they are no longer a customer.

If you choose to disable OCDD, a note will also be committed to Notes & Files recording OCDD was turned off for that client. Clients that have OCDD disabled will have a grey AML icon when they appear in the OCDD report.

Performing OCDD on clients

The OCDD flow retains historic IDVs and PEP check information. Plus, it analyses the previous IDV method, and either suggests an update in line with the latest guidance or keeps the previous IDV where it meets your needs. Whether you keep or re-do the IDV, you can still redo a PEP check as part of your OCDD.

Whether you use Sign Up with AML or AML Only, you can now:

Re-run the client through the AML flow

Add or remove beneficial owners

See an updated Companies Office search with analysis

Keep existing or re-do ID verification and PEP checks

Update CDD information ready for reporting and auditing

Build client CDD history, with full point in time due diligence snapshots

Getting Started

You can perform OCDD by kickstarting the CDD flow for an existing client, with all previous information available.

The OCDD function becomes available on the Client Management page once the initial client group has all IDVs completed, and the overall status is Complete.

Changes to Beneficial Owners

You can add or remove beneficial owners and update CDD information, all from the AML Page.

The Main Signatory/Contact and any Individual Clients must be Beneficial Owners and so cannot be deselected. You can still deselect other people listed as Beneficial Owners and record the reason, and use Add more to add Beneficial Owners as needed.

With companies that are clients, 2Shakes automatically shows you the CDD Reason last time alongside this time, so you have the information at hand to record your reason information. We populate the reason as much as we can from Companies Office or what we know about the client.

NB: If you see a person whose previous reason was Director or Shareholder of a Company, but now the reason is blank, they no longer have that role.

In the example above, both people are individual clients, which means their Beneficial Owner checkbox is greyed out, and they cannot be deselected as Beneficial Owners.

New Beneficial Owners this time show under Added Beneficial Owners. Since they are new this time they have no previous CDD Reason.

You can also see below that the checkbox is blue, and the person can be deselected if they are no longer a Beneficial Owner.

If there are other people under the 25% Beneficial Ownership threshold, use the Show more button (circled above) to view them.

Although they may be under the threshold they may still have a controlling position in your client, and may need to be selected as a Beneficial Owner. Always discuss both ownership and control of the client organisation to help record all Beneficial Owners.

ID Verification and PEP Checks

For historic individuals within the client group, the page will display the method of ID verification used previously as well as suggests an update in line with the latest guidance material.

(Sign up with AML agreement)

Users can edit the IDV method for each historic person and decide whether to keep the existing ID and or re-do the PEP Check.

If a new method of IDV is selected, the previous PEP check will not be kept, a new check will be included in the latest IDV.

If keep IDV and re-do PEP is selected, the PEP check will automatically be completed as soon as the client is progresses from Draft to In Progress. The new PEP check will be reflected in the IDV report.

Individuals who are newly added to the client group will appear under any historic people. Their IDV method can be selected as usual.

Watch OCDD in action

For both AML only and Signup with AML

Watch the video below to see Ongoing Customer Due Diligence being performed in 2Shakes.

NB: This video is yet to be updated following a feature update so some screens will look different to the screenshots above.

More Help

Didn’t find what you need here? You can find lots more help on our main Support Page.

Or you can contact us or email us at support@2shakes.co.nz and we can help you with what you need to know.

Thanks very much,

The 2Shakes Team